Between 2014 and 2024, global peacefulness declined to such an extent that there are now 56 active conflicts, more than at any time since World War II. The deterioration of the security environment ought to be understood in the broader context of the decline of the Liberal International Order; an order based on globalisation, international rules and the pursuit of democracy.

This Order has been unable to keep the peace due to the increasing conflict between different value systems across the world. Moreover, this conflict of values is why the global economic system is also unravelling. As noted in my recent book on liberalism, economic integration “requires a code of standards, values and principles … which assures material security for the claims arising from trade.” Hence without social and cultural integration, economic integration is inherently unstable.

Investors, therefore, need to understand the imposition of tariffs by the Trump administration as a symptom of this clash of values – although the erratic nature of policy interventions has meant that decision making on managing supply chains and investment is now much more challenging.

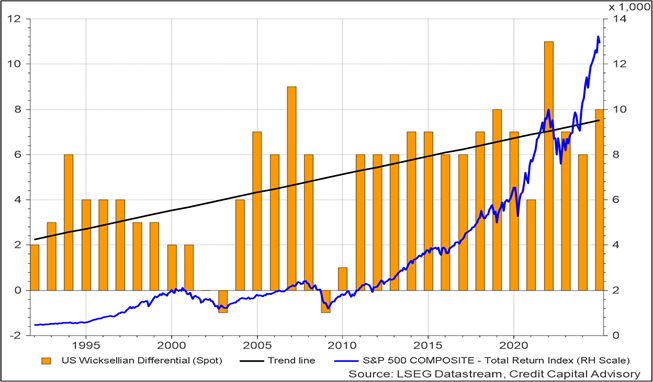

For investors, this has profound consequences given that the last 30 years of data provide little useful information to manage portfolios going forward. As observed in Chart 1, the upward trend of the Wicksellian Differential – defined as the return on capital minus the cost of capital – is closely related to the upward trajectory of equity returns. During this period, firms seeking the most profitable locations to increase the return on capital invested heavily into China.

Chart 1: Trend in US Wicksellian Differential and equity performance 1991-2024

China’s entry into the World Trade Organization (WTO) in 2001 catapulted the Chinese economy to become the world’s dominant trading nation by 2014. The result of this dramatic shift is that global trade is now dominated by a country that rejects the underlying liberal foundations of the global trading system. China’s strategic industries have been provided with vast subsidies by provincial governments to help firms generate a competitive advantage, which they now have, for example, in electric vehicles. But if that competitive advantage has been created by a breach of the underlying liberal principles of the trading system, it is unsurprising that this Order is breaking down. The General Agreement on Tariffs and Trade (GATT), the forerunner of the WTO, was predicated on a liberal understanding of an economy in order to protect the equality of competitive conditions.

The root cause of the decision by both the Trump and Biden administrations to place tariffs on China is therefore related to this clash of values. However, the imposition of tariffs on countries that do adhere to liberal principles suggests the Trump administration is now keen to accelerate the destruction of this unsustainable Order.

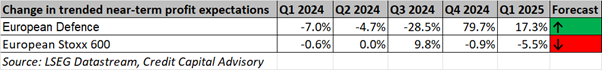

Last quarter’s credit cycle note forecast a slowdown in the trended near term profit expectations across the US economy. It also concluded that non-US firms with more complex products alongside European defence firms were likely to be able to maintain profit growth. Since March, European defence firms have outperformed the US market by more than 50%.

Chart 2: European Defence sector vs S&P 500

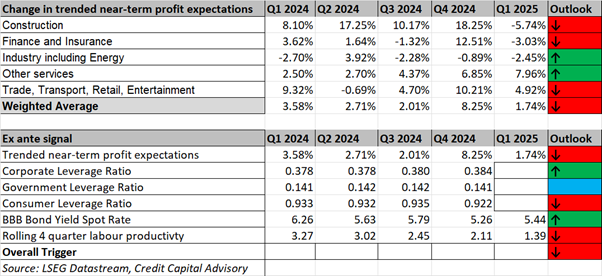

The near term outlook for US profits has deteriorated further, generating a negative signal with most sectors expecting declerating profit growth as shown in Table 1. While firms continue to invest, it is hard to see how they are going to be able to maintain profit growth if they are being forced to relocate production back to the US, which for many sectors will be a high cost and uncompetitive location. Even the rate of profit growth for the “Magnificent Seven” stocks is decelerating, indicating the US is less likely to generate the kinds of returns investors have gotten used to. In addition, consumers are increasingly deleveraging due to higher interest rates which will further reduce future consumption.

Table 1: US Summary ex ante signal

While the US economy is less likely to be the market of choice for international investors going forward, other markets are also impacted by the new global economic environment. Table 2 indicates that the top 600 European firms are also expecting declining profit growth. But it also shows European defence firms are expected to continue their upward trend of increasing profit growth, which will be required to justify the significantly higher price to earnings valuations.

The European Commission confirmed in March its higher defence spending through ReArm Europe Plan/Readiness 2030 which is designed to mobilize up to €800 billion for defence investments, including up to €150 billion of loans backed by the EU budget. Given the shift away from relying on the US for European security, there will be increasing pressure to buy European weapons platforms which in turn will continue to stimulate the demand for products from European firms. Future rises in capital values across the sector are, however, likely to be far more muted than they have been in the last quarter due to higher valuations.

Table 2: Stoxx 600 and European Defence profit outlook

With regards to the cost of capital, 10 year yields in the US and UK are likely to continue to rise gently towards 5% unless they experience a significant economic slowdown, which could be triggered by additional erratic tariff policy interventions. However, continuing inflationary pressures as result of more closed economies means there is unlikely to be a significant downward shift in yields at the long end of the curve.

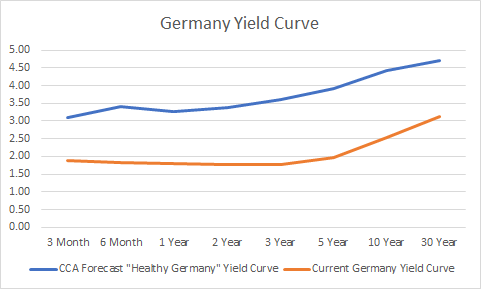

In Europe, if Chancellor Merz is able to stimulate growth across the German economy, then interest rates can be expected to rise along with nominal demand, which should be seen as a positive outcome as indicated in Chart 3. Although growth in Germany is likely to increase a little resulting in a small upward parallel shift of the yield curve, it is unlikely to be anywhere close to a “healthy Germany” steady-state curve. Many German firms have been closely tied to the export model grounded in the old Liberal International Order which will take years to unwind and develop new strategies for profitable growth.

Chart 3: Germany yield curve

Source: LSEG Datastream, Credit Capital Advisory

In conclusion, a new economic regime for investors is here to stay; one of global economic disorder. The sooner this is realized by asset allocators, the better. This also means largely junking the last 30 years of data that are related to an economic regime that is no more.