Private property plays a central role in liberal democracies as it protects a company’s right to contract with other agents in order to generate an income stream from its assets. Knowing that financial claims from contracts will be protected facilitates the trading of financial assets. The challenge for financial markets is that such claims do not necessarily scale internationally, particularly when claims are outstanding between liberal democracies and authoritarian states. This is why globalization has not proven to have been sustainable through history.

The German ordoliberal thinker, Alexander Rüstow, argued that sustainable international trade required the recognition of liberal ethical principles as a prerequisite, while James Meade noted the importance of countries pursuing similar policies with similar starting conditions. The success of GATT between 1948 and 1994 can be seen as evidence of this view. In essence, when the value systems of trading countries diverge, trade becomes unstable.

Arguments in favor of trade with authoritarian regimes are often justified by the view that increasing trade openness will lead to political openness, thereby driving political change in those countries. This has been the basis of the Wandel durch Handel (“change through trade”) policy of the Merkel administration in Germany. As Russian troops attempt to overthrow a liberal democracy and replace it with an authoritarian regime, such a trade policy has not only failed, but critically it is undermining the foundations of liberal societies by strengthening authoritarian regimes.

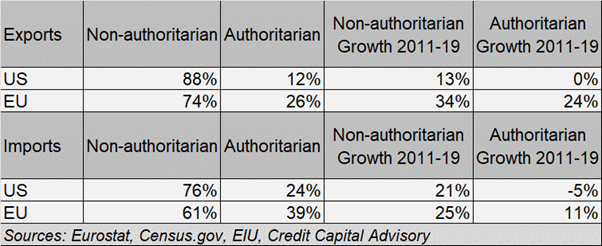

An analysis of the external trading of goods for the EU and the US highlights some striking results. As of 2019, the EU does more trade with authoritarian regimes (as defined by the EIU) than the US by a significant margin. The US exports just 12% to authoritarian regimes compared to 26% for the EU. The EU imports 39% of goods from authoritarian regimes compared to 24% for the US Another major distinction is that trade between the US and authoritarian regimes has declined between 2011 and 2019 whereas it has dramatically increased for Europe.

Table 1: EU and US external trade balance by authoritarian / non-authoritarian countries 2019

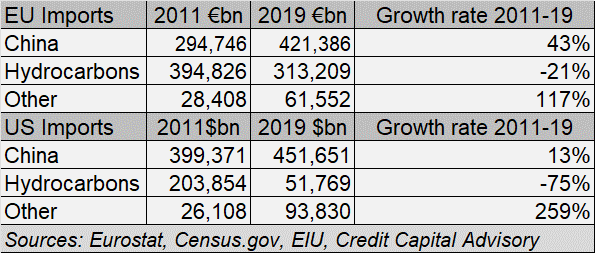

To make sense of the import data, it is important to disentangle the nature of trade with authoritarian regimes into two elements: China and hydrocarbon-focused countries – which are defined as countries where at least one-third of their total exports is hydrocarbons.

The data shows that both the EU and US continue to import an ever-higher portion of Chinese goods. And although the growth rate for Chinese imports has been higher for the EU than the US, this appears to be merely playing catch up in terms of absolute levels.

With regards to hydrocarbons exported by authoritarian regimes, imports into the US have fallen dramatically due to the development of its shale sector. While the EU has begun to reduce its demand for hydrocarbons from authoritarian regimes, demand remains extremely high.

Table 2: EU and US imports by type of authoritarian regime (trade balance)

The challenge for investors is that trading with authoritarian regimes not only undermines the liberal order, but this instability leads to trade disruption and a shift towards protectionism; both of which are inherently inflationary.

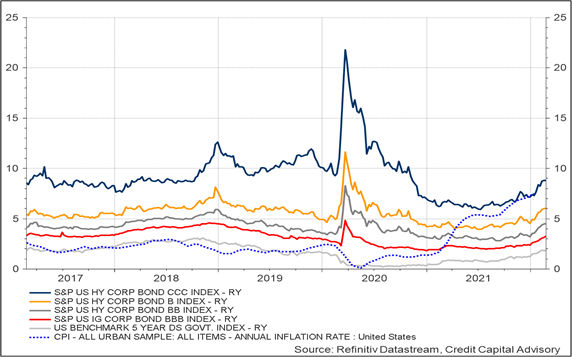

While the most recent quarterly signal for the US equity market highlights continued growth in profit expectations, rising inflation expectations and inflation will begin to impact the cost of funding, as well as the future returns on capital. The bond market has returned to its pre-pandemic conditions with the five-year benchmark ticking up towards 2% and the five-year BBB rate at 3.25%. Given the negative outlook for inflation, yields can be expected to continue rising.

Chart 1: Bond yields by rating band and inflation

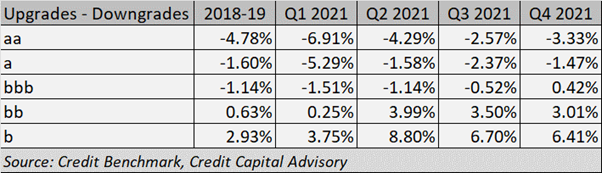

One positive piece of news for the Federal Reserve is that credit conditions remain robust across North America, according to the latest quarterly credit transition matrices from Credit Benchmark based on over 40,000 observations. Investment grade obligors are experiencing fewer downgrades than upgrades compared with the pre-pandemic period with bbb obligors seeing more upgrades than downgrades. Moreover, sub-investment grade obligors are still experiencing stronger upgrades than prior to the pandemic.

Table 3: North American corporate credit transitions by rating category

The outlook for inflation following the invasion of Ukraine by the Putin regime has shifted with increasing inflationary pressure. Alongside the anticipated rise in commodity prices and increased disruption to international trade, private sector wage growth has begun to accelerate at a rate faster than productivity growth. This will make inflation stickier, thereby reducing future real returns to investors.

Chart 2: US wages and productivity growth

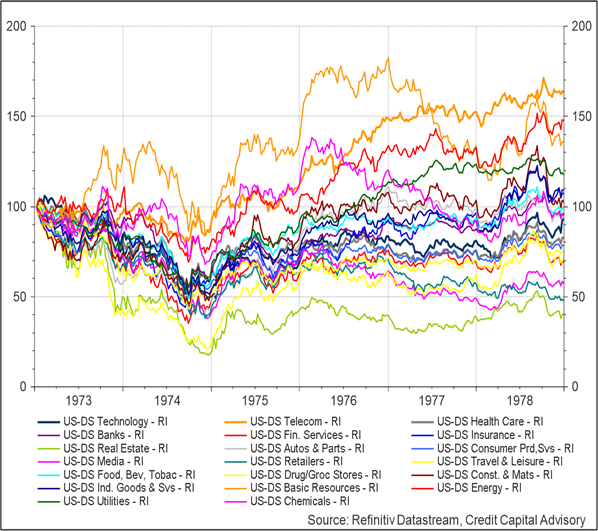

Set against a backdrop of rising bond yields, investors are left figuring out how to deploy their capital. Throughout the most recent earnings season, analysts have focused on which firms have sufficient pricing power to maintain profit margins. From a sectoral perspective, the six-year period between 1973 and 1978, where inflation averaged 7.7% per annum, provides some insight as to which types of firms are more likely to outperform. Despite the zero nominal return of the overall market, three sectors did outperform including energy, basic resources and telecoms, although investors should take note of sectoral structural changes since the 1970s.

Chart 3: US sectoral performance 1973-1978

The investment outlook is increasingly clouded, which is why investors seeking long-term returns must take far greater account of the current stresses on the international liberal order. This will require investors to promote the idea that freedom must be prioritized over maximising utility by governments.

For if freedom is not prioritized, the liberal order will flounder and so will wealth creation as I argue in my forthcoming book on liberalism. As has been made abundantly clear in the last few days, the blind pursuit of utility maximization and the dependence on trade with authoritarian regimes has major ramifications for the lives of citizens in liberal countries, as well as long term returns. Investors should take note and vote accordingly.