Markets on the whole do a decent job of synthesizing information at the micro level, but they often get the macro signals wrong as was noted by Paul Samuelson. In his 1998 paper, Samuelson argued that there is no persuasive evidence that macro market inefficiency is trending towards extinction!

One factor behind this inefficiency is that markets can progress at times based on memory rather than a random walk. This has particularly been the case for interest rates since the Greenspan Put was put on steroids in 1998 when Long Term Capital Management defaulted. The so-called Greenspan Put is where the central bank significantly reduces interest rates if it is concerned that the economy is softening. The basic idea is that the fall in interest rates will spur the economy back on to its expected long term growth trend through greater investment, stimulating employment.

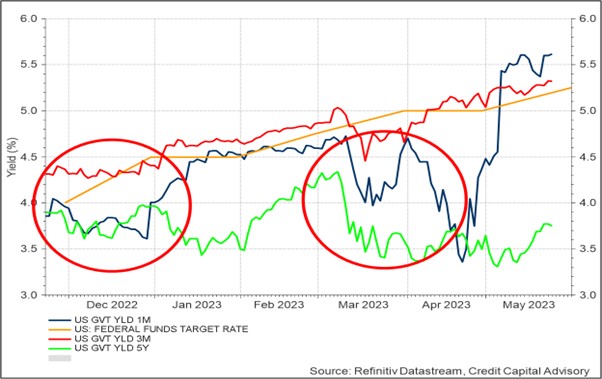

In the last six months, both the 1 month T-bill and the 5 year benchmark bond have fallen significantly below the federal funds target rate. The recent jump in the 1 month T-bill is related to concern over a potential US default. The inversion of the bond market where the 5 year yield is lower than short term rates can also be interpreted as the market expecting short term rates to fall due to lower demand.

Chart 1: US Interest Rate Movements

There are, however, two fundamental issues with this understanding of interest rates that investors ought to question.

First, is that while reducing interest rates tends to increase investment in assets such as property and equities – thereby driving up valuations – it won’t necessarily cause investment in the economy to rise. Indeed, firms tend to increase investment during a rising interest rate environment, not a falling one. Furthermore, it is slowly dawning on monetary economists that the transition mechanism of loose monetary policy, including quantitative easing, to Main Street is weak, particularly when compared to direct transfers to individuals which occurred during the Covid 19 pandemic which dramatically stimulated demand. It is also hard to argue that demand needs to be stimulated when unemployment is at 3.4%.

Second, when the Greenspan Put went into overdrive in the late 1990s, it coincided with the age of hyper-globalization when hundreds of millions of workers were entering global supply chains from China and India. This process dampened inflationary pressures that might have arisen from stimulating the economy with excess liquidity. However, the US economy is now lurching towards protectionism, while globally integrated economies such as China, no longer have a surplus of cheap labour. Hence, inflation is likely to remain far stickier than it has been, making the Fed think twice about reducing interest rates.

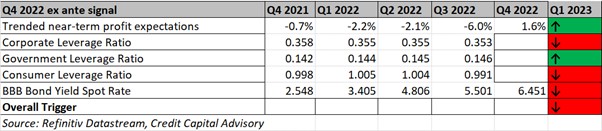

In terms of the outlook for investors, near term profit expectations are largely stagnant and consumers and firms have shifted into mild deleveraging due to concerns about future levels of demand, indicating downside for equity valuations.

Table 1: Outlook for US Wicksellian Differential

Combined with the computed ex post Wicksellian Differential which fell from 10.13% in 2021 to 9.51% in 2022, and the fact that the cost of capital for BBB firms has increased from just under 2.5% to over 5%, the odds are that the Wicksellian Differential will decline again this year. However, the data does not indicate that the return on capital will fall below the cost of capital as happened in 2008, indicating it will remain positive, albeit on a downward trend.

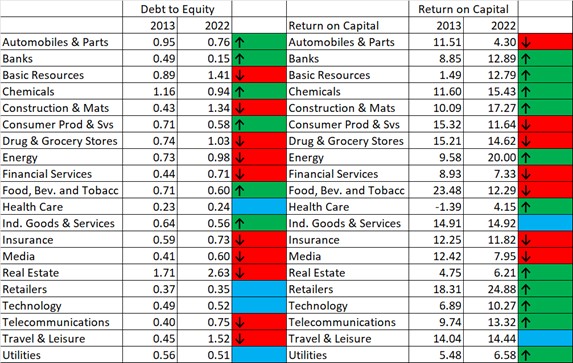

Although the US economy is clearly softening, it does not mean that it is now on the verge of an imminent collapse due to firms not being able to deal with higher interest rates. An assessment of the relationship between the change in the debt to equity ratio and the return on capital over the last 10 years highlights only a handful of sectors that currently look exposed to sustained higher rates. These instances are where leverage has increased significantly and returns have either fallen, or not increased sufficiently compared to the rise in leverage. Riskier sectors include Drug and Grocery Stores, and unsurprisingly, Real Estate. While Financial Services and Insurance are also indicating signs of deterioration, leverage is not significant on an absolute basis. Most other sectors though appear to be in reasonable shape in terms of the relationship between leverage and returns.

Table 2: US Sectors – Leverage vs Profits

Source: Refinitiv Datastream, Credit Capital Advisory

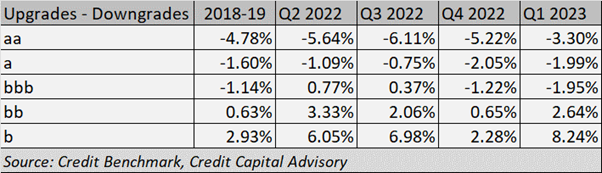

Further indications that large sections of the economy are able to deal with higher interest rates can be seen in the credit transition matrices for North American corporates. The Q1 2023 data indicates that the economy is now on par with 2018-2019 conditions with the exception of the bump in upgrades for single b entities. One reason for this stabilization is the ongoing buoyant labour market. And while most analysts are forecasting a rise in defaults, a large jump does not appear to be imminent. Timing, of course, matters for investors.

Table 3: Credit Transition Matrix – North America Corporates

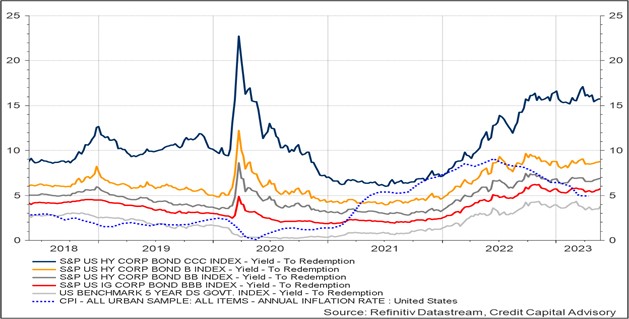

In addition, single B bonds and above continue to perform reasonably well and are likely to continue to do so in the short term assuming there is no US default. The bond index data also provides triangulation of the bank loan data within the credit transition matrix. Hence, given the downside outlook for equities, shorter term maturity bonds may well provide reasonable risk adjusted returns.

Chart 2: US Bond Market Indicators

The data sets highlighted, raise a critical question for investors which is whether interest rates are likely to fall back to the low levels experienced over the last 15 years. The answer to this question is surely no. As was argued above, inflation is likely to be much stickier given the new protectionist regime and hence is unlikely to re-anchor in the short term back on 2%. In addition, monetary economists are increasingly realizing that there are better ways to stimulate the economy than inflating asset prices. Finally, there is no fundamental reason why the economy, given it is less reliant on capital goods and hence debt financing for growth, cannot sustain itself at 5% levels of interest rates with low unemployment. And although profits are declining (from record highs) there is a long way to go before the Wicksellian Differential turns negative.

Trackbacks/Pingbacks