Ben Bernanke today spoke about how the Fed closely monitors asset prices. In his speech he stated:

“For the purpose of safeguarding financial stability, we are less concerned about whether a given asset price is justified in some average sense than in the possibility of a sharp move. Asset prices that are far from historically normal levels would seem to be more susceptible to such destabilizing moves.”

Given that one of the main drivers of unsustainable rises in asset prices is loose monetary policy, it is rather puzzling that the Fed is just monitoring rather than doing something about it. It appears that the Fed, like every other central bank, is still using inflation as its guide for asset price sustainability. This is not a very sensible approach to spot unsustainable rises in asset prices as demonstrated in the US in 1929, 2000 and 2007 and Japan in 1989.

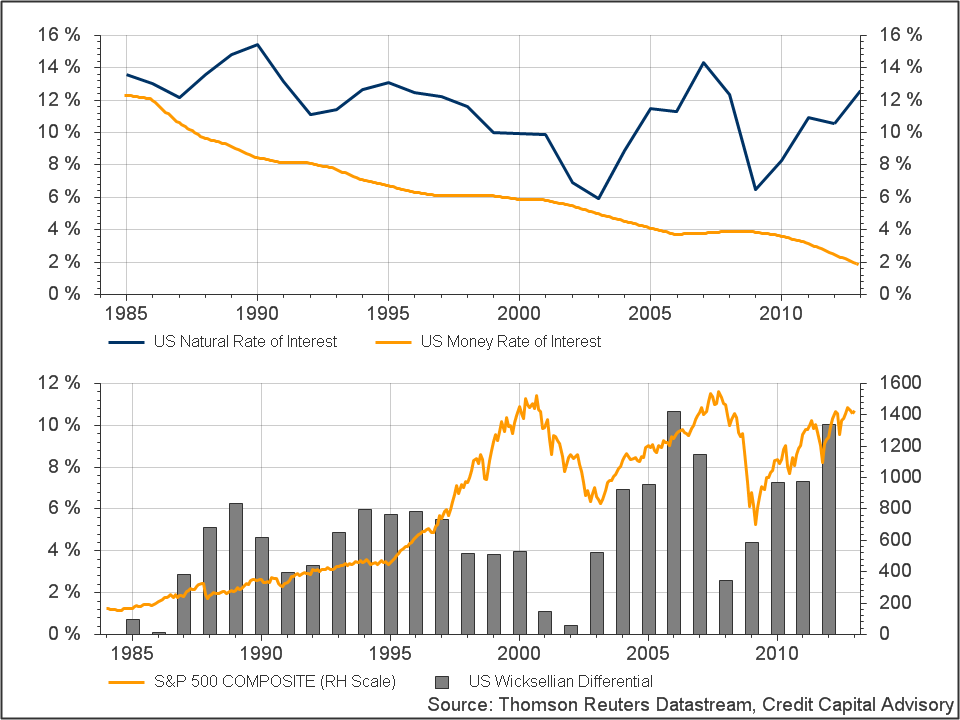

Using credit-based disequilibrium models it is reasonably straight forward to spot unsustainable rises in asset prices. They are caused by the cumulative growth in credit driven by the difference between the return on capital and the cost of capital. The below chart shows the fall in the US money rate of interest – driven by Fed policy – against the US natural rate of interest. As this gap grows – known as the Wicksellian differential – it drives credit growth. The challenge for investors is to ride the boom and get out in time before assets crash. Investors can sit tight for a little longer as interest rates are staying put and profits still growing.

Trackbacks/Pingbacks