At the beginning of 2013, Credit Capital Advisory put out a note on asset allocation and how credit based disequilibrium models can help understand the general direction of equity price movements. This was the general summary:

The ex-ante estimates for 2013 show a continuing positive outlook for profits in Canada, the United States and Japan, with the United Kingdom still in negative territory. The outlook for the United States has been boosted by the fall in consumer leverage. However Canada remains dangerously exposed to a reversal given its high level of consumer leverage although for now it appears to be resisting a shift towards negative profit expectations. Japan’s rate continues to rise, but its lower absolute level implies lower absolute returns. Finally the United Kingdom is still recovering from the massive slump in the financial services sector which has severely damaged profit growth across the economy.

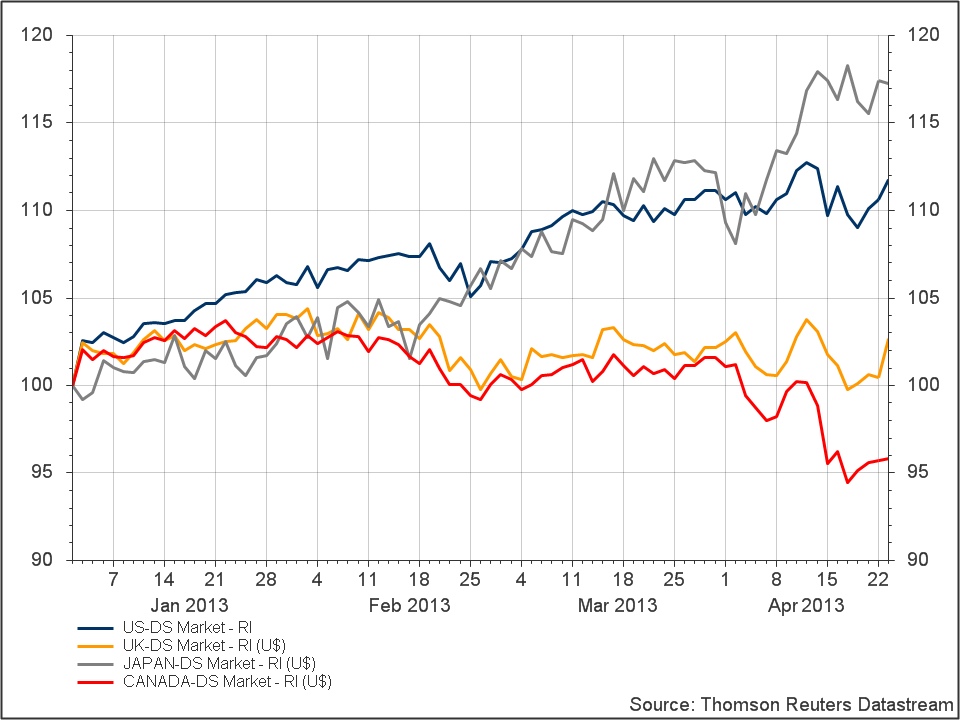

With a third of the year almost gone, it seems worthwhile to compare how well the model has worked in relation to equity returns data. Chart 1 shows the comparable nominal total returns in US dollars for the four countries.

Chart 1: Nominal total returns for USA, UK, Canada & Japan

In general the data shows that the model has worked reasonably well with regards to asset allocation. Firstly, the US market, which generated the strongest signal of future profit and by implication credit growth, has performed well with a nominal return of nearly 12%. The UK, which was the only economy generating a negative signal has seen nominal returns of only 2.5%, half of which has been eroded by inflation. Although UK equity returns have outperformed government bonds by around 1%, some of this outperformance can be attributed to the general equity correlation effect given the performance of the US market.

Interestingly, the two countries which demonstrated positive outlooks but with mixed signals have seen dramatic differences in performance year to date. Firstly the Canadian stock market has performed badly, down 4% year to date – mainly due to the fall in natural resources stocks. Given the lack-luster performance of the market, the shift towards negative expectations for the rate of profit in Canada is increasing. However, one challenge with such models is that it is impossible to predict exactly when expectations of the sustainability of leverage will turn negative. The dramatic rise of leverage of economic agents in Canada since 2008 cannot continue indefinitely. With respect to Japan, the credit signal was positive however, the absolute levels of the return on capital cannot justify the dramatic performance of 17% year to date. It seems that Abenomics has clearly impacted the value of Japanese equities to a degree, hence it is unclear just how sustainable this rise in equity valuations is without seeing a substantial increase in the return on capital for Japanese companies.

In summary, credit based macroeconomic theories do indeed provide useful investment signals in order for the protection of capital through the credit cycle.